Australia 200 Index approaching support of a Channel Down

Australia 200 Index is approaching the support line of a Channel Down. It has touched this line numerous times in the last 13 days. If it tests this line again, it should do so in the next 2 days.

Dramatic change in Hong Kong 50 Index. A sign of things to come?

Hong Kong 50 Index rose sharply for 4 hours – which is an excessively big movement for this instrument; exceeding the 98% of past price moves. Even if this move is a sign of a new trend in Hong Kong 50 Index there is a chance that we will witness a correction, no matter how […]

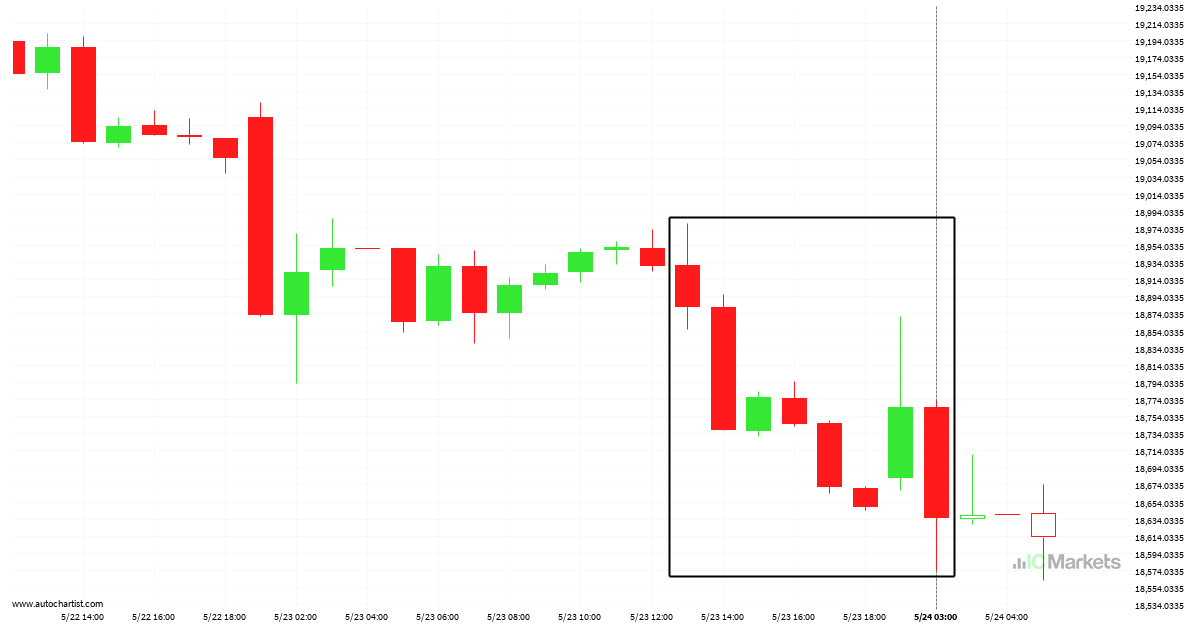

Hong Kong 50 Index is on its way down

Hong Kong 50 Index hits 18584.17 after a 2.01% move spanning 14 hours.

A final push possible on FTSE China A50 Index

FTSE China A50 Index is heading towards 12888.0498 and could reach this point within the next 13 hours. It has tested this line numerous times in the past, and this time could be no different, ending in a rebound instead of a breakout. If the breakout doesn’t happen, we could see a retracement back down […]

Either a rebound or a breakout imminent on FTSE China A50 Index

FTSE China A50 Index is heading towards the resistance line of a Rising Wedge. If this movement continues, the price of FTSE China A50 Index could test 13038.9200 within the next 2 days. It has tested this line numerous times in the past, so this movement could be short-lived and end up rebounding just like […]

Hong Kong 50 Index is on its way up

Hong Kong 50 Index rose sharply for 16 hours – which is an excessively big movement for this instrument; exceeding the 98% of past price moves. Even if this move is a sign of a new trend in Hong Kong 50 Index there is a chance that we will witness a correction, no matter how […]

Australia 200 Index approaches important level of 7733.0801

Australia 200 Index is moving towards a support line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 4 days and may test it again within […]

Where is Hong Kong 50 Index moving to?

Hong Kong 50 Index has moved higher by 2.74% from 19064.81 to 19586.62 in the last 3 days.

FTSE China A50 Index short term bullish trade setup to 12785.7002

The movement of FTSE China A50 Index towards 12785.7002 price line is yet another test of the line it reached numerous times in the past. We could expect this test to happen in the next 2 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound back […]

Should we expect a bullish trend on Australia 200 Index?

Australia 200 Index has broken through a line of 7790.2300. If this breakout holds true, we could see the price of Australia 200 Index heading towards 7823.0132 within the next 2 days. But don’t be so quick to trade, it has tested this line numerous times in the past, so you should probably confirmation the […]